Contact us

401 W. Kennedy Blvd.

Tampa, FL 33606-13490

(813) 253-3333

With the advent of online banking options (from paying bills to transferring money and depositing checks) the need to visit a brick-and-mortar branch has become less necessary for people of all ages — and especially for Generation Z (people born between 1995—2015). Tampa-based investment advising company Manole Capital Management recruited the help of a group of interns from The University of Tampa, University of Florida, Indiana University and Lehigh University to conduct its third annual Gen Z Financial Service Survey on banking, brokerage, digital currencies and the payment sector.

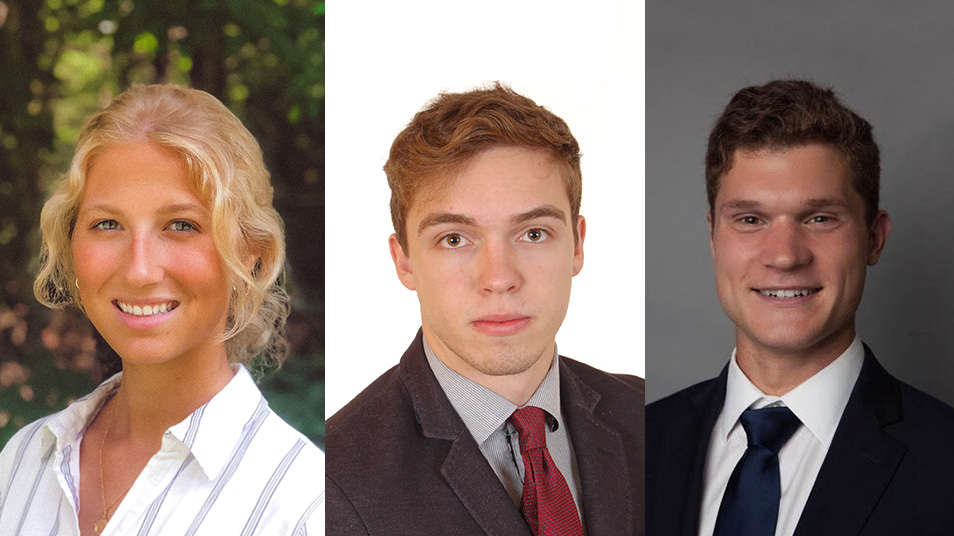

From left Laurel Jones, Luis Delaye and David MacKinnon, all May 2020 finance graduates, were interns for Manole Capital this summer.

“This research was very important to do and share with the public because the upcoming trends of the banking industry play a big part in a lot of people’s investing strategy,” said Luis Delaye, who joined UT interns Laurel Jones and David MacKinnon, all May 2020 finance graduates, in the research. “The FinTech industry is an emerging industry, and it’s crucial to know what it entails and what new trends will shape it.”

From left Laurel Jones, Luis Delaye and David MacKinnon, all May 2020 finance graduates, were interns for Manole Capital this summer.

Read more UT Life stories.

Subscribe to News and UT Life.

More UT News